Will Apple Watch Make Time for Hollywood?

After revolutionizing the way Hollywood gets its content in front of mobile consumers with the iPod and iPad, the time has come for Apple to prove whether it has developed another viable distribution platform with its smallest screen yet: a watch.

With a press event scheduled for March 9 — before a retail rollout in April — Apple will reveal the partners behind the first round of apps on its smartwatch.

In the past, Disney has been an early adopter, making its films and TV shows available on Apple’s mobile devices before other studios through the iTunes Store. The deal was a feather in the cap of Disney CEO Bob Iger, who has always tried to keep his company on the cutting edge.

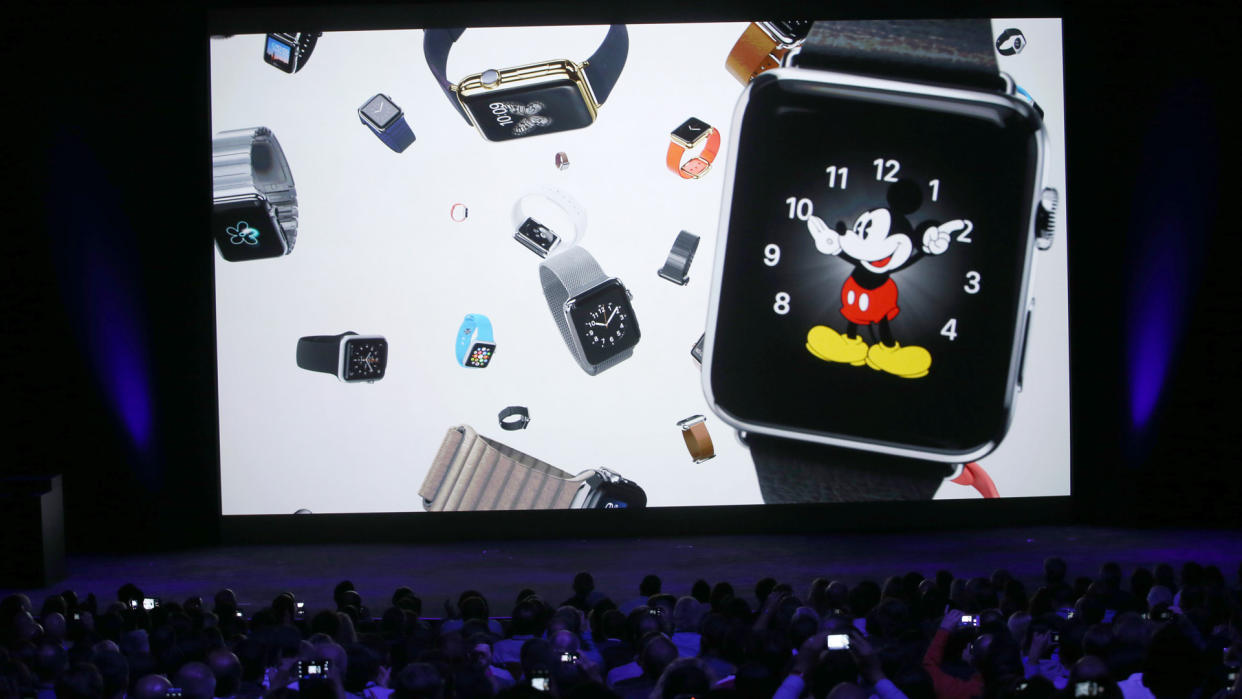

The Mouse House could lead the charge in some form again; an Apple Watch version of the iconic Mickey Mouse watch has already been promised as an option for purchase. ESPN could also become a significant player given that up-to-the-minutes scores from the latest games would be a natural application. The sports broadcaster is launching a complete overhaul of its online presence this spring.

Another company that featured prominently in Apple’s device launch plans was News Corp. When a subscription option was introduced to Apple’s iPad, CEO Rupert Murdoch joined Apple for a joint press conference in 2011 to unveil the first publication, the Daily, created exclusively for that line of tablets. But that effort didn’t go over too well; the Daily was shuttered by the end of 2012.

Expect Facebook and Twitter to step forward and plant their social-media presence on the Apple Watch screen. And CNN could also be a potential partner for Apple Watch, with breaking-news alerts an obvious feature. The Time Warner-owned news network was an inaugural content partner for another innovative device, Google Glass, though in retrospect that didn’t really help the product get off the ground.

But Apple isn’t necessarily banking much on traditional content to power its new device’s screen this time around. It’s not as if it’s large enough to provide more than short bursts of texts or photos: The Apple Watch screen measures 1.5-1.7 inches. It’s not yet clear if it can play video.

In its initial announcement of the device, Apple introduced an app from American Airlines that will enable travelers to use the watch to check into their flights. Since then, an app from hotel operator Starwood will let wearers do away with the traditional room key and open their doors digitally, while one from Panera Bread will serve as a digital wallet to pay for food, a feature that will promote Apple Pay.

With heart rate and motion sensors built into the Apple Watch, the company is clearly looking to enter — and dominate — a wearables market mostly made up of fitness trackers and smartwatches produced by companies like FitBit.

Apple also is targeting the $3 trillion health care market. Any apps sold for the watch, including those that can monitor glucose levels, would boost sales for the App Store, which generated $15 billion last year, up from $10 billion in 2013.

Yet with an iPhone required to make or receive calls, listen to music, interact with an iPhone camera, or control and Apple TV set-top box, the Apple Watch could also interact with versions of apps that appear on the smartphone, opening the door to potential new entertainment uses for the small device.

Whether they are tied to the entertainment biz or not, early app makers are expected to reap the financial rewards of appearing on the Apple Watch.

Analysts expect as many as 15.4 million Apple Watches to ship around the globe this year. That’s compared to 12.7 million smartwatches from all other manufacturers like Pebble, Motorola and LG combined, according to research firm Strategy Analytics.

Compare that to only 4.6 million smartwatches shipped in 2014. Apple has requested manufacturers to have 5 million smartwatches ready for the first quarter alone, when the device will become available to consumers.

Apple won’t feel much of an impact should its watch not dial up buyers.

The company is sitting on $178 billion in cash and investments. Its iPhone buisness drives much of its bottom line, with the company selling 25 million iPhones each month during the fourth quarter of 2014.

But should interest in its watch translate to sales, Apple could easily capture 55% of the smartphone market around the globe this year, analysts say — and make more consumers pay attention to the overall wearables market.

“The Apple Watch is the catalyst to ignite the global smartwatch market,” said Strategy Analytics executive director Neil Mawston. “Apple’s famous brand, loyal fan base, deep retail presence and extensive apps ecosystem will ensure healthy uptake for its Watch.”

Apple has had time to line up partners since unveiling the watch last September, with over 100 developers said to have been invited to design apps for the April launch.

Originally pitched as a fitness and activity tracker, the base model will be priced at $349, while one made of gold will come with a hefty pricetag, that many say will could be as much as $5,000.

Analysts like Mawston do have their concerns, however.

“Apple’s Watch hardware design is arguably less attractive than some rival models such as the Huawei Watch, battery life may not be as long as many traditional wristwatch owners are used to, and Apple’s premium pricing may be challenging for mass-market consumers,” he said. “Apple will need to upgrade tangibly its second-generation Watch to stay ahead of competitors later this year.”

Related stories

HBO Standalone Internet Service Dubbed 'HBO Now,' Network in Talks with Apple: Report

Sneak Peek: Apple's Oscar Commercial with Martin Scorsese

Apple Orders 5-6 Million Smartwatches for Initial Launch: Report

Get more from Variety and Variety411: Follow us on Twitter, Facebook, Newsletter